Frequently Asked Questions

These Frequently Asked Questions should be read in conjunction with the following policies:

- Expenses Policy

- Travel Booking Policy

- Corporate Card Policy

- Purchasing Card Policy

- Financial Regulations

- Conflicts of Interest

Please note, the expenses policy and process facilitates the re-imbursement of expenditure incurred whilst travelling on University business.

Expenses

I have been charged data roaming costs for using my personal mobile abroad when away for work. Can I claim these back through the expenses process?

Yes, reasonable data roaming costs for work related expenses whilst travelling on University business can be claimed but they are taxable expenses. When the claim is paid your project code will be charged an additional amount of around 59% for tax. Data roaming charges for streaming will not be reimbursed.

Data charges for work related activities should not be incurred by staff whilst abroad on holiday.

I am overseas on business travel and my laptop has broken. Can I buy a new one and claim it back on expenses?

The University’s policy is that the purchase of laptops and IT equipment is permitted only via published procurement channels and is not a permitted expense claim.

Re-imbursement for such items via expenses is considered a taxable benefit on which tax is due at a tax rate of between 50-95%, therefore purchasing equipment in this manner is extremely costly to the University. Where such items are claimed via expenses, the budget holder and Head of College Finance would need to factor the significant additional tax charge as the relevant project code will be charged the additional amount for tax, and therefore approve in only the most exceptional circumstances. All other routes to obtain necessary IT equipment must be explored in the first instance.

I need small equipment for working from home. Can I purchase this and claim it back on expenses?

No, such purchases are not permitted via expenses. As per the Hybrid Working FAQs, “no homeworking or equivalent allowance is available due to the non-contractual nature of hybrid working. Colleagues should discuss any equipment requirements with their line manager and an appropriate on campus workstation should always be available if required.”

I am hosting research workshops with volunteers and want to provide refreshments. Can I purchase these myself and claim them back?

No, for events held on campus, colleagues should use the University’s internal catering facilities. If this is not possible, select a University approved supplier from the contracts register and raise a purchase order for the supplier. If an event is held off campus, use the catering services provided by the selected venue.

I am unable to use Selective, am I able to pay for my accommodation and reclaim this back?

Travel should be booked in accordance with the University’s Travel Booking Policy, available on the Procurement Office webpage.

The University Supplier for ALL domestic and international travel, and other travel related requirements is: Selective Travel Management. Selective Travel Management has provided a self-booking online Travel Hub portal for all bookings inclusive of Air, Rail and Accommodation for both domestic and international travel. The travel Hub portal also provides the advantage of instant booking confirmations and eliminates the need to raise a Purchase Order. The online booking tool is simple to use and the quickest way for you to book travel. All travel bookings can be made online however, if your travel request is not available via the online Travel Hub booking platform or if your travel requirement is complex, please contact Selective Travel Management direct who have a dedicated team that will support your travel booking request(s). All University business travel requirements to be booked through the appointed provider. In the event that Selective Travel Management cannot provide a solution to your travel requirement please contact the Procurement team who will provide guidance and support.

In all cases, the use of Airbnb, or similar, is prohibited, and accommodation should only be sourced from regulated providers. The University has a duty of care to staff and students whilst they are travelling on University business, and these considerations must be applied in sourcing all accommodation.

I need to pay a subscription for software or a license which is required for my job. Can I claim this back via expenses?

Subscriptions for software or licenses are not permitted via expenses.

In the first instance you should contact the University’s IT Services and your School/Department’s local IT services, to check if the software is permissible and whether the University already has a license for a particular type of software. If required to purchase software and/or license subscriptions, these should be paid by purchase order via the relevant supplier.

I need to pay an annual membership fee for a professional body. Can I claim this back on expenses?

No, the University’s policy is that subscriptions for professional memberships are not paid by the University.

I need to use my car for business travel. How do I claim back mileage?

When using a car for business purposes, you must first consider whether the use of a private vehicle is in accordance with the University’s Guidance for Sustainable Business Travel for Staff and Postgraduate Researchers.

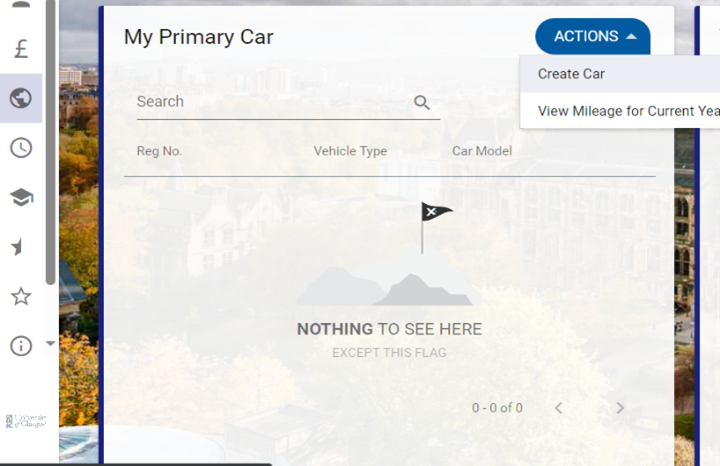

If an employee wishes to claim mileage on their car, they will need to register their car on PeopleXD. This is found on the employee dashboard.

All details will need to be input correctly for the car to be approved and to ensure the employee receives the correct mileage rate.

The following details include:

- Vehicle registration

- Vehicle make/model

- Date of registration

- Engine capacity (CC), EG. If the car is 1.3L, 1300 cc. If unsure, this can be found on DVLA website

- Fuel type

- Insurance details

- License type/expiry

When selecting the approver, you can select any of the possible approvers in the drop-down menu.

Once your car is registered, you will still need to submit a mileage claim for each approved trip.

I am relocating to Glasgow for this job. Are my relocation costs claimable via expenses?

No, if you are relocating to Glasgow for this job, relocation expenses may be agreed with HR as part of your employment package at the discretion of the hiring department. Such payments are not claimed via the expenses, if approved, payments are processed via Payroll as an Additional Payment, upon instruction from the HR onboarding team, and any tax due on these will be applied via payroll.

I need to pay a work visa renewal fee. Can I claim this back via expenses?

No, payment of work visa renewals cannot be claimed via expenses. Where visa fees are approved, such payments are processed as an Additional Payment via Payroll, acting upon instruction from a School or Department’s HR team.

I want to purchase clothing for doing my job and claim this back. Can I do this?

No, you cannot claim clothing for work purposes. Where clothing is required, the University will provide branded clothing for doing your job, through University approved suppliers.

Approving Managers must first refer to Section 27 of the Expenses Policy for full information. Clothing purchased in respect of performance of an employee’s duties which is not ‘safety equipment’ e.g. high vis jacket, or does not have the University’s logo on it, is a taxable benefit on which tax is due at a tax rate of between 50-95%.

I want to host an event with some staff members and some non-staff members. What are the tax implications of doing this?

This would depend on the purpose of the event. If the event is purely social, then there will be a benefit-in-kind charge levied on the department. Please refer to Section 26 of the Expenses Policy for full policy information.

I have paid for a lunch with a mixture of research students and staff. What type of expense should I submit this as?

The following table will help you to establish whether a meal or drinks is subsistence, staff entertaining or business entertaining.

|

Subsistence |

Staff Entertaining |

Business Entertaining | |

|---|---|---|---|

| Definition |

Food and drink for employees while on business travel. |

Restaurant meal or catering for an employee only event. |

Restaurant meal or other entertainment where one or more of the participants is an external visitor to the University. |

| Limits |

Limited to £20 per day per employee for day trips and £60 per day per employee for overnight trips. |

Staff entertaining falls outside of the expenses policy and so requires approval for the cost and tax cost from Head of School/Department and College Head of Finance. |

Expenditure should be reasonable and commensurate with the seniority of the external visitor. |

| Tax implications |

Non-taxable. |

Taxable at a rate of 50-95% (typically 60%) which will be charged to the same project code Note, if UoG internal catering services are used, then the cost will be non-taxable. |

Non-taxable if all staff attending are doing so in a business, rather than social, capacity. If any staff do attend in a social capacity, then the cost of their attendance should be coded to Staff Entertainment. |

| Examples |

Breakfast/lunch/dinner whilst on a research field trip in Norway. If one member of staff pays and then claims on behalf of other staff/students on the trip, they must provide names of those staff and/or specify how many students were present. |

Head of School organises a leaving event for a member of staff with 30 years of service and buys in catering from an external provider.PI takes research group to a restaurant in Glasgow to celebrate winning a significant award. |

Lunch/ dinner/drinks with research partners from other organisations or students. |

I am finding it difficult to set up a supplier on our systems. Can I pay the amount myself and claim it back through expenses?

No, when purchasing goods or services for the University, other than the exceptional items listed under Q13, reservation and/or payment for goods or service using personal means on behalf of the University is strictly prohibited, you will not be reimbursed. You must never ask another member of staff to pay a supplier personally as they will also be unable to claim via expenses or sundry payment. Please refer to the financial regulations and procurement policies for further guidance.

To emphasise, if you pay a third party who is providing goods or services to the University, you will not be reimbursed.

The primary purpose of the expenses policy and process is to reimburse staff for relevant costs while travelling on University business.

I have a cake-making side business and have been asked to make a cake for a retirement against payment. Can I claim this on expenses?

No, such payments cannot be reimbursed via expenses, the expenses policy relates only to expenses incurred in the course of your employment. If you are providing a product or service to the University, this cannot be claimed via expenses. Instead, payment is processed as a supplier for the service you are providing. Please refer to the New Supplier Process, and the Conflicts of Interest Policy.

I require to purchase and distribute vouchers, e.g. for fieldwork participant incentives. Can I claim this on expenses?

No, vouchers for any purpose must be purchased via the University supplier Love2shop per the procurement link below. Reimbursement of vouchers is not permitted via expenses.

For payments for research participants, refer to the Research Participant Payment Guideance.

Examples of items which are not permitted to be re-imbursed via expenses and therefore should not be purchased directly by individual staff members or appro

The following is a list of examples of items which are not permitted to be claimed via expenses. This list is not exhaustive, staff and managers must refer to the expenses policy and FAQ’s above prior to purchase/payment or approval.

- Reservation or hiring of external venues

- Course/conference fees

- Journal submission fees

- Image reproduction fees and licences

- Computer accessories, cables, chargers, adaptors, USB’s, etc.

- Gifts - where approved must be obtained, for example, from the Visitor Centre using a purchase order

- General equipment, tools, cleaning products, etc.

- Office decorations

- SIM cards

- Research/study books (refer to Manager/Study Sponsor)

- Competition prizes (for Students or otherwise)

- Stationery – must be obtained via central departmental supplies, expenses policy allows only for small operational items e.g. stamps, notebooks (not including research/study books)

Expense Submission

The Expenses Guide takes you in detail through making an expense claim in Portal.

I have multiple receipts and it is very time consuming to submit each one separately. Can I submit them all as one line with one photo of all receipts attached?

it is permissible to combine receipts rather than submitting them all separately, however, you need to follow the following principles:

if you attach more than one receipt, each receipt must be clearly visibleif there are different currencies used, receipts in different currencies must not be attached to the same lineit must be clear what exchange rate you are usingyou can combine all receipts for the same type of expense for each trip – e.g. all subsistence, or all taxi fares, for a particular trip could be added togethereach trip needs to be submitted separately – you cannot, for example, include one line for all subsistence for multiple tripsfinance must be able to view the amount in your submission agreeing to the receipts attached, therefore, if you are attaching more than one receipt, you must add these together on the receipt or attach an excel sheet which shows the reconciliation to the expense submission.

*Any lines for which receipts are unclear, or do not reconcile with the amounts claimed will be rejected.*

I am having issues populating some of the fields in my expense claim – the appointment ID field is not working. What should I do?

Usually, problems with using PeopleXD Expenses are due to browser issues. Try using a different browser, or Windows rather than a Mac. You should not have a problem using Microsoft Edge or the People XD app.

I want to claim an amount of £260 for an expense type of “Other”. Can I do this?

The expense category of “Other” is only for incidental operational expenditure, which should not be more than £100. If you need to buy operational items over this value, it should be paid with a purchasing card, via Sundry Payments or via Accounts Payable. You must not split the amount across expense lines to force through an expense claim, this constitutes a breach of policy.

I cannot find the sub project code in the drop-down list, what should I do?

All sub projects are available for all staff, however, to access a sub project you need to first select the correct cost centre code that the sub project is associated with. Your local Administrator or College finance staff should be able to provide you with the appropriate cost centre code.

I’ve submitted my expense report before I have completed it, what can I do?

So long as your expense report has not been approved by finance you can ‘un-submit’ your report. To do this, go to your Employee Dashboard and select Expenses. Click on Manage and choose All Expense Reports. Locate your submitted expense report and from the three dots select Unsubmit. The Status of your report will now have changed from Submitted to New and you can edit your report by again clicking the button in the Actions column and selecting View / Update. See the section on keeping track for your expense report for further details.

My expenses were approved by my line manager but rejected by Payroll. If my line manager has approved them, why can they still be rejected?

Pay and Pensions are responsible for ensuring compliance with the expense policy and HMRC regulations. To do this, Payroll review expense claims and must reject items which are not compliant with the policy. Managers are also responsible for ensuring compliance prior to approval and are not authorised to override expense policy.

I have realised that I have expenses which are more than 90 days old and which I haven’t submitted yet. Can I still submit them?

Expense claims must be made within three months of the expense being incurred. Expense claims out-with the time limit will be rejected and can no longer be claimed.

I keep getting error messages when I try to enter expense details.

If you are not using Microsoft Edge already, try accessing your portal and entering your expense on Edge. The system does not run quite as smooth on Chrome and Safari and especially mac users can encounter some issues with the website.

Exchange rates

The exchange rate charged on a foreign trip was different to the rate which auto-populates on PeopleXD. How can I use the correct one?

The exchange rates are uploaded by finance each Monday. However, there may also be more unusual currencies for which an exchange rate is not uploaded.

If you received a different exchange rate for your purchases, and you have evidence of this, i.e. a credit card statement or receipt from a bureau de change, you can override the default exchange rate. Evidence of the exchange rate applied must be included with the expense claim attachments.

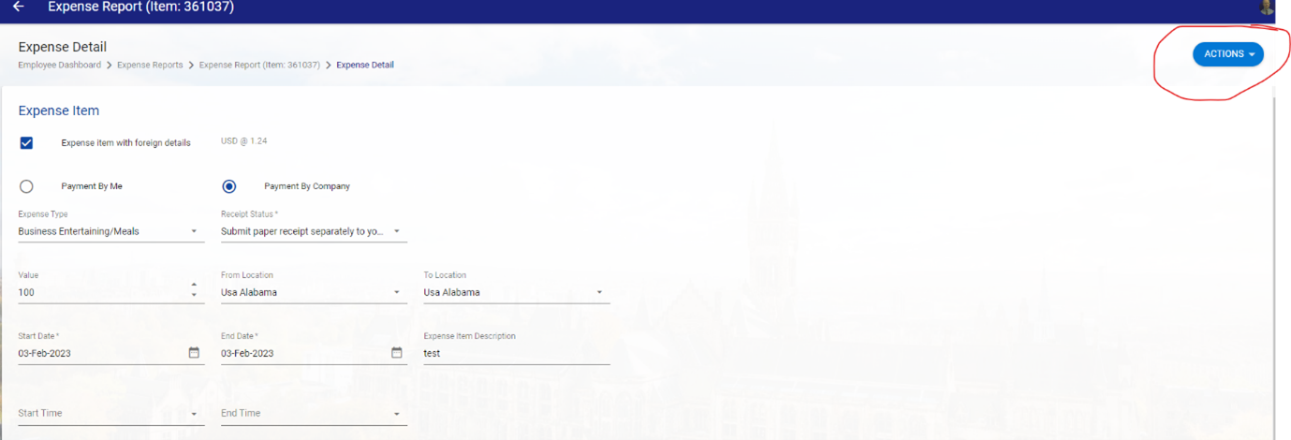

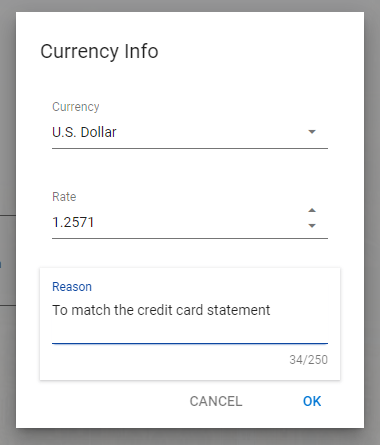

The ACTIONS button at the top right of the screen allows you to update the exchange rate of the transaction.

This opens a small box that allows you to input the new currency rate.

Expense Advances

I am travelling for business soon and expect the costs will be high. I do not want to pay this upfront. Can I receive an advance for anticipated expenses?

You can request a business expense advance, as outlined in Section 8 of the Expenses Policy. Please select and complete the Advance Expenses Request Form.

It is important to note that:

- This is a loan from the University to the staff member.

- Expenses claims must be submitted within 90 days of receiving the advance.

- Failure to submit expenses within the timeframe will result in the advance being deducted from your salary.

- The amount of advance requested must be estimated as accurately as possible based on the duration and nature of the trip to avoid the potential requirement to repay unused balances or require recovery from salary.

I already have an expense advance but I need another one for another trip or for the same trip. How can I get one?

You must submit expenses to clear the full amount of the existing advance before a further advance can be issued. Note that the process for running both expenses and expense advances is initiated on a Monday. Therefore, you will need to have expenses pertaining to the existing advance submitted and approved before one expense run and thereafter your new advance can be approved and paid in the following week.

Another staff member has asked me to get an advance on their behalf because they already have one outstanding. Can I do this?

You must never obtain an advance of behalf of another member of staff. An advance paid to you, will remain a balance owed by you to the University, and will be recovered from your salary if expenses are not submitted within 90 days. This will be the case regardless of whether you have transferred this money to another employee. Staff members must never ask another member of staff to do this for them.

I received an expense advance and submitted expenses which cover most of the advance, but there is an amount that I didn’t spend. How do I return this?

Any unused expense advance amounts can either be paid back to the University’s payroll bank account or it can be deducted from your next salary. Please raise an enquiry with the helpdesk to agree return of the funds.

I need to make a deposit payment to a venue to keep the reservation. Can I receive an advance for this?

Deposits or any payment to venues for events should not be paid via expenses. Deposits/payments for venues must only be paid by setting the venue up as a supplier and raising a purchase order. Purchasing cards are not permitted to be used for booking bars or restaurants. If the amount is less than £1,000, and no other payments have been made to the supplier in this financial year, it may be possible for the venue to issue an invoice for the deposit that can be paid as a sundry payment through Accounts Payable. The process for doing this is on the AP website.

I am currently working my notice period / my contract is ending soon, can I still get an advance for a business trip?

Before approving a Business Expense Advance, managers must confim that staff members will submit the expense claims to clear the advance within their employment period.

Corporate Cards

I travel a lot for work and would prefer not to have to pay for these costs up front all the time. Are there any other options?

Transport and accommodation should be booked and purchased through Selective, so you will not incur these costs personally.

For subsistence, business entertaining, and other incidental costs of travel, if you travel a lot on business, you have the option of either receiving business expense advances as outlined above, or you can apply for a corporate credit card. The application process is handled by the University’s procurement team.

Corporate cards are approved by the Executive Director of Finance. Use of corporate cards are strictly per the expenses and corporate card policies.

Please note that, whilst the process for submitting detail of the expenditure incurred on your corporate card is separate from the process for claiming expenses, you must still retain all receipts and submit these using the Corporate Credit Card Expenses process each month.

Expense Cost Allocations

There have been costs posted to my project code which should be on a different project code. Can they be moved to the correct code?

Once expenses are finalised through Pay & Pensions, the Pay & Pensions team cannot move these to another project code. Your College Finance teams can move costs from one code to another code should there be an error.

STUDENT EXPENSES / PAYMENTS TO NON-STAFF MEMBERS

A student in my school/research group needs to be reimbursed for some expenses they incurred. How do I do this?

Student expenses are paid via the Sundry Payment route, which is owned by Accounts Payable, please refer to this link for full guidance, and specifically the ‘Information for Students’ section, including policy, guidance, and claim form.

We need to pay summer school teachers a set fee of £200 for the work they have done for us. How do we do this?

Summer school teachers should be set up as Casual Workers using the Extended Workforce Policy. Contact your local HR team to do this.